Salary calculator plus overtime

1830 per month 18304 45750 per week Divide the weeks pay by the number of hours worked ex. Of overtime hours Overtime rate per hour.

Overtime Calculator To Calculate Time And A Half Rate And More

We use the most recent and accurate information.

. -Overtime gross pay No. Get Your Quote Today with SurePayroll. So if your regular.

Free online gross pay salary calculator plus. Calculate the gross amount of pay based on hours worked and rate of pay including overtime. Determine your multiplier m which you can see in the overtime policy of the company.

48 x 15 720. Unless exempt employees covered by the Act must receive overtime pay for hours. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes.

Ad Payroll So Easy You Can Set It Up Run It Yourself. You can claim overtime if you are. Heres a step-by-step guide to walk you through.

30 x 15 45 overtime. This overtime calculator figures your total overtime paycheck and the OT rate together with the regular pay by taking account of the number of hours worked. Calculate the complete payment for the week.

For the cashier in our example at the hourly wage. Overtime pay of 15 5 hours 15 OT rate 11250. Work out your overtime with our Overtime Calculator.

The federal overtime provisions are contained in the Fair Labor Standards Act FLSA. For instance if the policy states a time-and-a-half rate this means that m 15. The employees total pay due including the overtime premium for the workweek can be calculated as follows.

This free paycheck calculator makes it easy for you to calculate pay for all your workers including hourly wage earners and salaried employees. Get Started Today with 2 Months Free. 4 x 40 160-hours.

All other pay frequency inputs are assumed to. Generate your paystubs online in a few steps and have them emailed to you right away. The Fair Labor Standards Act FLSA Overtime Calculator Advisor provides employers and employees with the information they need to understand Federal overtime requirements.

Summary report for total hours and total pay. Divide the pay by four work weeks to get their weekly pay ex. The algorithm behind this hourly paycheck calculator applies the formulas explained below.

2 x 225 45. 1200 40 hours 30 regular rate of pay. Since overtime pay starts after 40 hours worked a week according to FLSA rules calculate the employees regular wages using the regular hourly rate.

If you are a monthly-rated employee covered under Part IV of the Employment Act use this calculator to find out your pay for working overtime. 1500 per hour x 40 600 x 52 31200 a year. If you expect the.

Calculate the overtime pay which is the number of overtime hours x the overtime hourly rate. Ad Create professional looking paystubs. -Total gross pay.

This salary calculator assumes the hourly and daily salary inputs to be unadjusted values. Due to the nature of hourly wages the amount paid is variable. All Services Backed by Tax Guarantee.

Your employer is required by federal law Fair Labor Standards Act to pay time and a half wages regular hourly rate x 15 for all hours worked beyond 40 hours per week. This shows you the total pay you are due of regular time and overtime.

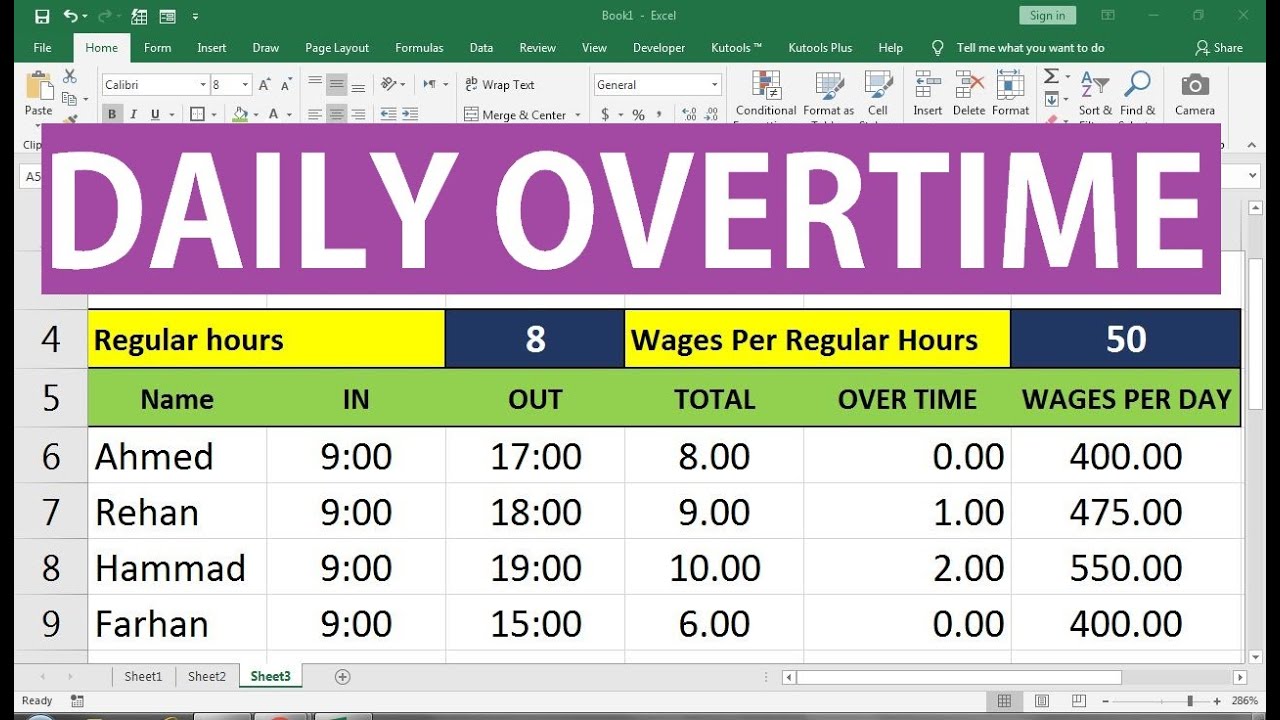

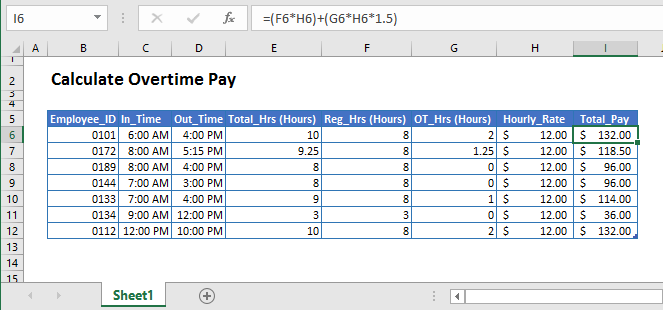

Overtime Calculation Formula In Excel Youtube

Overtime Pay Calculators

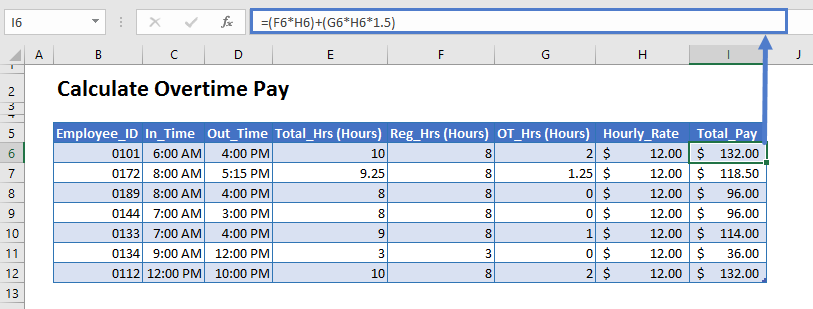

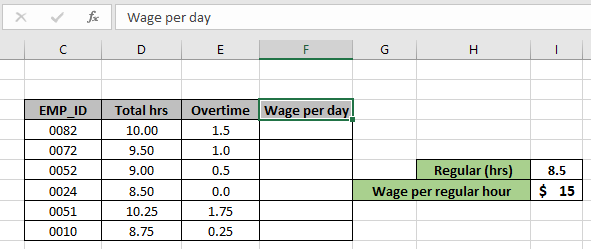

Excel Formula Basic Overtime Calculation Formula

Overtime Pay Calculators

Overtime Pay Calculators

Calculate Overtime In Excel Google Sheets Automate Excel

Pay Calculator With Overtime Online 59 Off Www Ingeniovirtual Com

Hourly To Salary What Is My Annual Income

Calculate Overtime In Excel Google Sheets Automate Excel

Excel Formula Timesheet Overtime Calculation Formula Exceljet

How To Calculate Overtime Pay Easy Overtime Calculator A Basic Guide

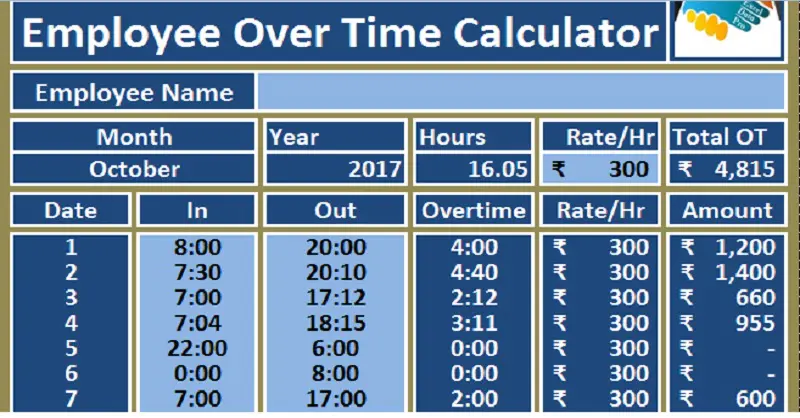

Download Employee Overtime Calculator Excel Template Exceldatapro

Overtime Calculator Workest

Pay Calculator With Overtime Online 59 Off Www Ingeniovirtual Com

Pay Calculator With Overtime Online 59 Off Www Ingeniovirtual Com

Overtime Calculator

How To Calculate Overtime Pay For Hourly And Salaried Employees Article